CFO AI Use Jumps 21% YOY & Banks Are Quietly Picking AI Vendors

Here's what happened this week in AI x Banking.

Hi everyone! Greenlite team here. The fall is already in full swing, with banks and fintech companies traveling to conferences from now till early November. We're planning on attending ACAMS Vegas and Money 20/20 this year—if you're around and want to chat about AI & banking, send us an email!

In today's packed issue, we highlight a new Gartner report on CFO AI adoption, share more data on what bank executives are interested in when it comes to AI, and explore how banks are quietly picking AI vendors to work with.

Gartner Says CFO AI Adoption Jumped 21% in 2024

At the Gartner CFO & Finance Executive Conference 2024 in London yesterday, the research firm shared new data on how quickly AI is being adopted by finance teams at companies, according to a recent report.

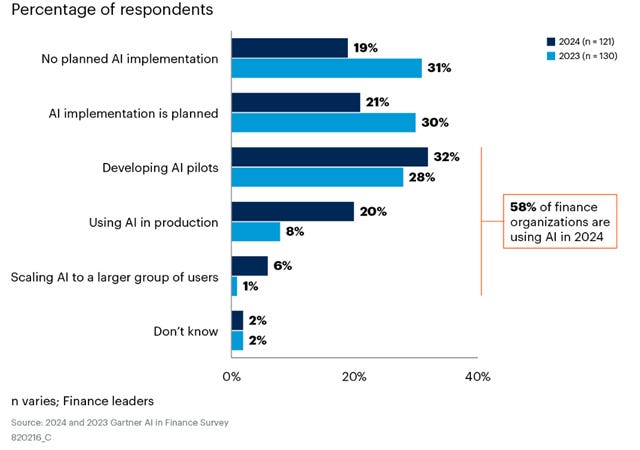

58% of respondents significantly increased their use of AI in 2024, a 21% jump from 2023.

66% said they feel more optimistic about AI's impact on the CFO suite than they did a year ago, hinting at rising optimism among CFO leaders.

Of the 42% of the 121 finance leaders who took the survey and aren't currently using AI, half are planning to implement it in some capacity.

The CFO suite seems uniquely susceptible to Generative AI. There's a ton of number crunching necessary, and much of the data is unstructured, existing only in paper form, and fragmented across the company.

The survey shows that use cases are focused on solving these specific problems:

44% use AI for "intelligent process automation," incorporating AI into existing automation tools to improve information sharing and processing

39% use AI to find errors and anomalies in large datasets, like internal claims, expenses, and invoices

28% use AI for analytics, like better forecasting and analysis to boost decision-making

27% use AI to make decisions similar to those made by humans around better operational choices

Where Banks Are Placing Their AI Bets

A recent CNBC report (paywalled) discusses how banks are using AI to boost their profitability. It covers topics we've already written about extensively—using chatbots to better serve customers, employing copilots to improve internal operations around research and information gathering, and enhancing fraud detection systems.

However, the article also highlights an important trend—every bank is picking a different vendor, building out its own relationship.

This is playing out similarly to how big tech companies have operated:

Apple, Microsoft, OpenAI: Apple is working with OpenAI on Apple Intelligence, and both companies are board observers for the AI company.

Amazon & Anthropic: Amazon has invested heavily in Anthropic, while Anthropic has agreed to use AWS as its main cloud vendor (essentially sending the money back to Amazon in the form of AWS revenue).

Google & Facebook: These two have prioritized building out their own AI divisions. Google has been heavily marketing Gemini, while Facebook's strategy has been to undercut everyone and launch open-source LLMs for free, which are also being adopted by banks.

For banks, it seems the big deciding factor has been geographical location, which might make sense given how regulated financial services and AI are going to be. Regulation at this level is decided on a per-country basis, so working with domestic providers can offer a deeper understanding of the regulatory hurdles.

Examples of bank-AI partnerships:

BNP Paribas & Mistral: BNP, a French bank, is using the French AI startup to embed LLMs across customer services, sales, and IT

Wells Fargo & Google: Fargo, a chatbot for customers to help answer questions and execute simple tasks like checking credit limits, is powered by Google Cloud's AI

Morgan Stanley & OpenAI: One of the first Wall Street banks to launch AI products, Morgan Stanley's chatbots are built on OpenAI tech. AI @ Morgan Stanley helps advisors quickly answer questions about investments and the market, while "Debrief" helps financial advisors generate notes based on client meetings

Deutsche Bank & NVIDIA: In 2022, these two partnered up to develop apps for fraud protection

TD Bank & Cohere: This Canadian duo announced a partnership in July 2024, allowing the bank to utilize Cohere's LLMs

We highly expect to see more partnerships over the coming years. Similar to tech giants, it doesn't make much sense for financial services firms to start building their own foundational models from scratch. The tech is already very good, the capital expenditure costs are enormous, and it'd largely be viewed as a futile project with a very low likelihood of success. As banks start to use and build more AI products, expect them to start making more direct bets in the form of venture investments as well.

How Banks Internally Make AI Decisions

Another day, another survey. As a reminder, it's important to use these data points as pieces of a larger puzzle and not take everything they say at face value. However, a lot of the data here is pretty compelling—specifically on how banks actually make decisions around AI products.

According to a survey of 98 senior executives at leading firms by data analytics company EXL:

85% said their board of directors is involved at the decision level for Generative AI projects

49% said that the biggest hurdles are explaining what AI does and a lack of leadership buy-in

Other issues mentioned were costs & budgets, lack of resources, and legacy systems integrations preventing AI projects

Much of this aligns with industry thinking—while there are some champions inside companies who are excited about using Generative AI, they need to be cheerleaders internally as well. And they need to be beating that drum incessantly. The corporate politics of banks make it hard to really go out on a limb without knowing the ROI.

Similarly, because AI is so new and potentially fraught with regulatory issues, it makes sense that decisions around using or building Generative AI products are being escalated to the top of the institution. It's something for AI companies to think about when selling to financial institutions—while some are fully on board, larger institutions still have some hesitancy they need to overcome.