Building AI Talent & The Benefits of AI Compliance

Here's what's going on in banking & AI this week.

Hope everyone’s having a great week! Lots going on at Greenlite, but we we’re still able to fit in a great team picnic in Golden Gate Park this weekend. It was a blast—folks brought their spouses, friends, drinks and snacks. Some crowd favorites were Pineapple buns from Pineapple King, tacos from a food truck nearby and a cake from Tartine!

It was great to relax and hang out—if you’re in SF and want to join next time, just send us a message.

How Bank’s Are Keeping Talent Up To Date On Gen AI

A bunch of interesting talent related news earlier this week hints at how banks are thinking about AI talent.

Over the last week, we’ve seen some interesting moves:

Keeping up with productivity trends: American Banker wrote about something that’s pretty top of mind for bank execs—how are employees using AI? It’s “hidden” because if banks aren’t aware of the use, and regulators start restricting publicly available gen AI products for financial institutions, the banks could be on the hook without even knowing it. The only way to get ahead of this is to create the right guidelines and framework to enable proper use of gen AI, which takes time to develop.

Better Training: In the meantime, some institutions are leaning into Gen AI and providing their employees with the tools and training to succeed. VentureBeat wrote about how S&P Global, one of the leading information providers in banking, is working with Accenture to train all 35,000 employees on how to use Gen AI.

Hiring AI Leadership: Still, great AI leaders within banking are hard to come by. So it’s notably that Lloyds, the banking and insurance provider, hired Rohit Dhawan, an AWS veteren who spent almost 5 years at the cloud company. Lloyd’s isn’t the only one; Morgan Stanley recently hired a head of AI as well.

Over the next decade, talent is going to be the biggest issue for banking and AI. Engineering is becoming more commoditized over time, with AI and an influx of developers, solving talent supply issues for banks on that front. But, having people that can think about how to implement AI strategies inside financial firms is going to be tough to find.

So far, we’re seeing banks taking a few different approaches. To us, the most compelling one is around retraining existing employees to make them experts in Gen AI. If that can happen, perhaps banking can hold off the job displacement that many are predicting in the sector.

Think your friends will like “Banking on AI”? Hit the share button to send it to them or share it on socials.

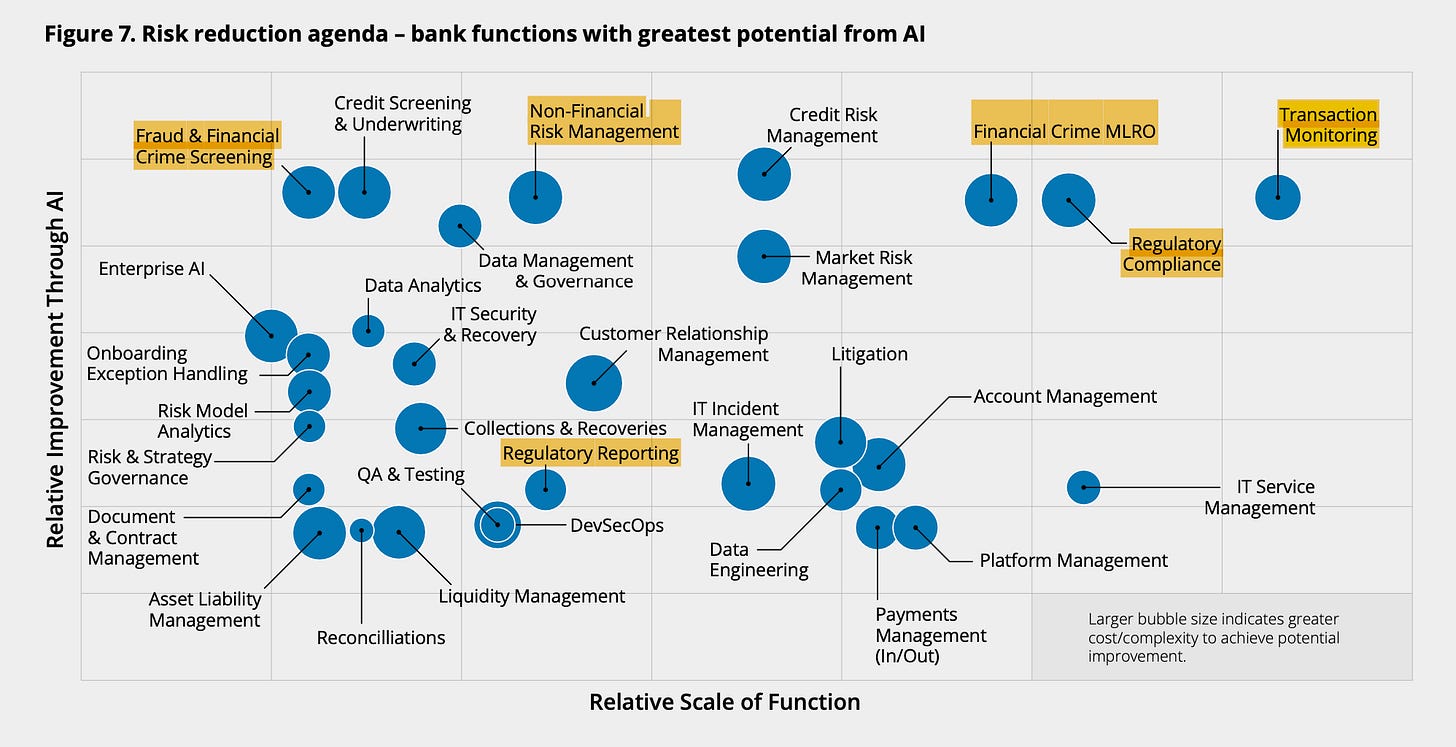

Deloitte Sees AI Reducing Risk & Cost For Financial Crime, Compliance

A new Deloitte report (PDF ) went in depth on the potential changes that AI can have on banking.

While the whole report is worth a read, one area we wanted to highlight was the charts on cost & risk reduction.

Compliance was one of the only areas that saw huge benefits in both cost and risk reduction. Deloitte writes that that’s because they’re so closely tied together—if there’s increased compliance risk there usually is associated costs in the forms of fines and penalties. If compliance risk goes down, so do the chances for fines.

Subscribe and get “Banking on AI” in your inbox weekly.

Citi Sees $2 Trillion In AI Profits By 2028

Citi Indonesia’s CEO Batara Sianturi made some bold comments about the potential AI can have on the banking industry.

"Artificial intelligence (AI) will change the future of the financial industry. AI has the potential to increase the profits of the global banking industry by up to 2 trillion US dollars in 2028, an increase of 9 percent in the next five years,” Sianturi said at a conference earlier this week. He added that banking in particular is an industry that will benefit from AI—it’s a data-rich sector and a lot of players can adopt this new tech quickly.

Citi Indonesia is a foreign subsidiary that operates under the global bank, and mainly caters to businesses dealing in cross-border banking. It’s a massive business that has a lot of visibility into worldwide banking trends—it facilitates $5 trillion in payments a day across 180 countries. Given its reach and scale, we should really pay attention to Sianturi’s projections.

Thanks for reading! To learn more about Greenlite, visit Greenlite.ai. If this newsletter was sent to you, subscribe to get “Banking on AI” in your inbox every Thursday